STORY: From a key reading of U.S. inflation to a possible interest rate cut in the UK these are the stories to watch in business and finance in the coming week.

:: U.S. inflation

U.S. inflation data due out May 15 is set to show consumer prices cooled last month after three straight months of hotter-than-expected readings.

Economists polled by Reuters expect the consumer price index to have gained 0.3% in April.

But any more evidence of sticky inflation could dash hopes of interest-rate cuts in the near future and reignite market volatility.

:: Japan’s economy

First-quarter growth figures out Thursday will reveal whether the Japanese economy began 2024 on strong footing.

But the BOJ’s preference to keep monetary policy accommodative for now is unlikely to take the pressure off the yen, as interest rates elsewhere remain at multi-decade highs, squeezing households further as import costs rise.

:: China’s property sector

April home price data on May 17 will be the next barometer of health for China’s beleaguered property sector.

The release comes alongside China’s retail sales and urban unemployment rate figures due the same day and on the heels of disappointing May Day spending data.

:: UK labor markets

The Bank of England is expected to cut interest rates this year as inflation has eased, but it remains on alert for pay rises refueling price pressures ahead of fresh labor market data due on May 14.

Traders see a good chance rates will fall in June.

But the central bank might need more time and data to be sure that Britain has escaped a wage and price spiral.

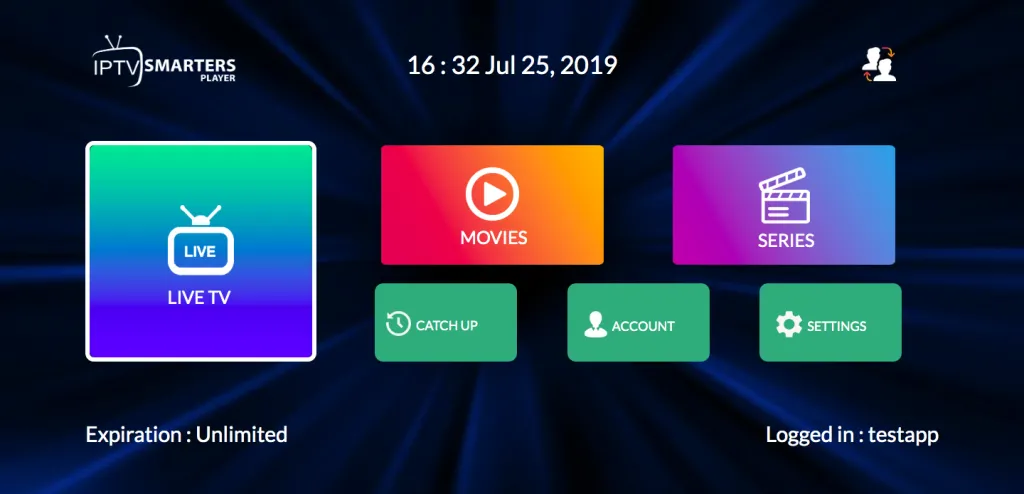

Business Lookahead: Escaping the spiral – Best iptv services

[url=http://www.g7y6bpn0g76h6oo39j54kjf8pl51785fs.org/]uwxnrqntjz[/url]

awxnrqntjz

wxnrqntjz https://ssiptv.live/