Deploying this strategy allows Amazon and Super Micro to move faster and win over the competition.

Two of the biggest long-term winners in the stock market, Amazon (AMZN -1.07%) and Super Micro Computer (SMCI -0.15%), don’t have much in common at first glance. The former is an e-commerce leader and inventor of cloud computing. The latter is a manufacturer of data center servers.

But there’s more in common than meets the eye. For one thing, both companies operate in fairly cutthroat, low-margin businesses: retail and server hardware.

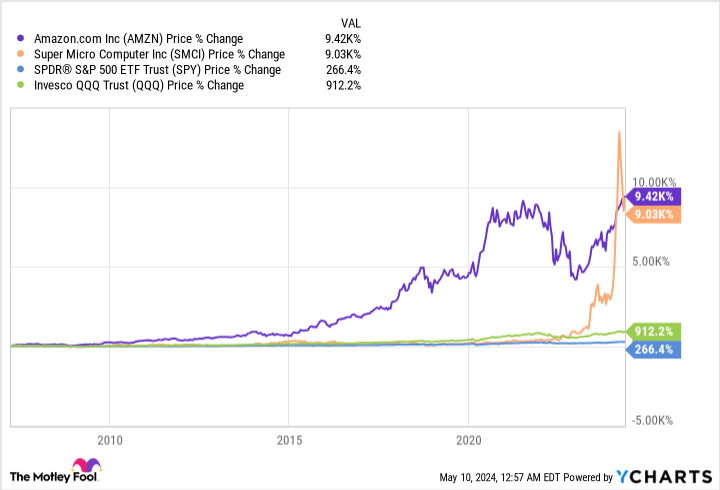

Yet despite being in such difficult businesses, each has managed more than 9,000% returns (that’s 90x) in the stock market over the past 20 years. That’s more than 10 times the return of the Nasdaq 100 and over 33 times the return of the S&P 500!

This unconventional success for both Amazon and Super Micro can largely be attributed to another similarity between them: Both companies use an unconventional “building block” approach to product development.

Building blocks to build an empire

“Building blocks? Like Legos?” you might ask. “How would that simple concept result in such incredible business outperformance?”

The concept of breaking down your products and services into their smallest possible component parts might not blow you away at first. But the results have certainly been mind-blowing.

In fact, the strategy is so important to Amazon that CEO Andy Jassy devoted basically his entire 2023 letter to shareholders on the concept. And 2023 was a great year for Amazon. Over the past 12 months, free cash flow hit a whopping $50 billion, up from a $3.3 billion free cash outflow over the 12 months ended in March 2023.

Meanwhile, Super Micro has been touting its building block architecture for years. But as the computing world shifted from traditional computing to artificial intelligence (AI) acceleration, the inherent advantages of Super Micro’s 30-year-old building block strategy suddenly came to the forefront, leading to its recent triple-digit growth.

Amazon and Super Micro each use a building block strategy. Image source: Getty Images.

How Amazon uses “primitives”

In his shareholder letter, Jassy outlines Amazon’s evolution to a building block strategy, or what the company calls “primitives,” as the correct approach for unlocking creativity of customers and employees alike:

What matters to builders is having the right tools to keep rapidly improving customer experiences. The best way we know how to do this is by building primitive services. Think of them as discrete, foundational building blocks that builders can weave together in whatever combination they desire.

Jassy describes the revelatory moment in the early 2000s when Amazon first opened up its highly trafficked e-commerce page to third-party sellers. One early customer trial was with Target (TGT -0.72%).

Back then, Amazon had a highly integrated e-commerce platform across payments, search, item management, and other aspects. But when Target wanted to use Amazon’s back-end platform to power the nascent target.com, the solution didn’t work well. Amazon realized it needed to break down each capability into individual application programming interfaces (APIs) that customers could optimize in whatever combination they wished.

The resulting system was much better, and eventually led to the ultimate success of Amazon’s third-party business, in which brands use a combination of Amazon’s fulfillment, delivery, inventory management, and advertising services. Today, Amazon’s third-party seller services account for a majority 61% of the company’s paid units globally.

That revelation over primitive building blocks also led to what became Amazon Web Services (AWS), which started in 2006 with one simple, optimized primitive: its Simple Storage Service (S3).

S3 was meant to do one thing extremely well: object storage. Today, Amazon has over 240 optimized primitives that all work together seamlessly and can be mixed and matched according to any developers’ wishes.

Developers are clearly in love with these flexible capabilities across storage, computing, data analytics, and many other functions. Today, AWS is a $100 billion run-rate business and still growing at a 17% clip.

How building blocks optimized Super Micro for the AI age

Fortunately for Super Micro, its founder and CEO Charles Liang envisioned the building block strategy nearly 30 years ago. Traditional server OEMs (original equipment manufacturers) would mass-produce standard models in order to simplify their manufacturing, while ODMs (original device manufacturers) would sell individual components or “white box” solutions to companies that built their own servers, or even to OEMs themselves.

However, Super Micro took a middle path, building and optimizing each component of a server — including microprocessors, graphics processing units (GPUs), memory, storage, power, networking, interconnect modules, and others — but then having every building block able to be integrated into a complete system.

Developing building blocks from an array of semiconductor, networking, and storage companies and then engineering them to work seamlessly together in any combination is no easy task. But once done, there are a number of advantages to the model.

First, Super Micro can customize its servers according to customer specifications easily and quickly. In the hypercompetitive age of AI, companies are building massive, complex models at enormous cost and trying to optimize and differentiate any way they can, so that customization capability is a huge advantage.

And because each new chip only has to be inserted into its new building block and not an entire system, Super Micro can produce servers with a new block quicker than it would take to configure an entire new server design.

And in an age of supply shortages, one block can also be swapped for another into a server and shipped, rather than Super Micro having to wait for a sold-out part to arrive. As leading AI and cloud companies are clamoring to be first-to-market with the latest AI capabilities, Super Micro’s fast time-to-market is a second big advantage.

Finally, there’s the issue of cost. AI systems are extremely expensive, as evidenced by the recent capital expenditure increases disclosed by most “Magnificent Seven” companies this earnings season. But Super Micro’s building block architecture saves a huge amount in costs. Data center operators that use its servers can merely swap out a new block or module of a server, rather than having to buy an entire new system — a big savings in refresh costs.

The cost, speed, and customization advantages of the building block model have really come to the fore in the age of AI, and Super Micro is reaping the benefits.

Slower at first, but faster in the long run

With these seemingly obvious advantages, one might ask, “Why don’t all companies use the building block strategy?”

The answer is likely that it requires foresight, long-term thinking, and a more deliberate pace of development — at least at first. But once the architecture is in place, the pace of innovation accelerates. As Jassy explained in the letter:

As a builder, it’s hard to wait for these building blocks to be built versus just combining a bunch of components together to solve a specific problem. The latter can be faster, but almost always slows you down in the future … One of the many advantages to thinking in primitives is speed … Primitives, done well, rapidly accelerate builders’ ability to innovate.

In the business world today, innovation is happening faster than ever. That’s why these two forward-thinking companies, which have taken the time to develop a building block model, are now outpacing their rivals.

Looking for your next multibagger investment? If you find a company that uses modular building blocks in an industry in which its competitors don’t, you might have just found one.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.